XRP Price Prediction: 2025-2040 Outlook and Key Catalysts

#XRP

- Technical indicators show XRP trading above key moving averages with bullish momentum indicators

- Fundamental developments including institutional adoption and stablecoin integration provide strong support

- Long-term growth potential driven by cross-border payment adoption and possible ETF approval

XRP Price Prediction

Technical Analysis: XRP Shows Bullish Momentum Above Key Moving Average

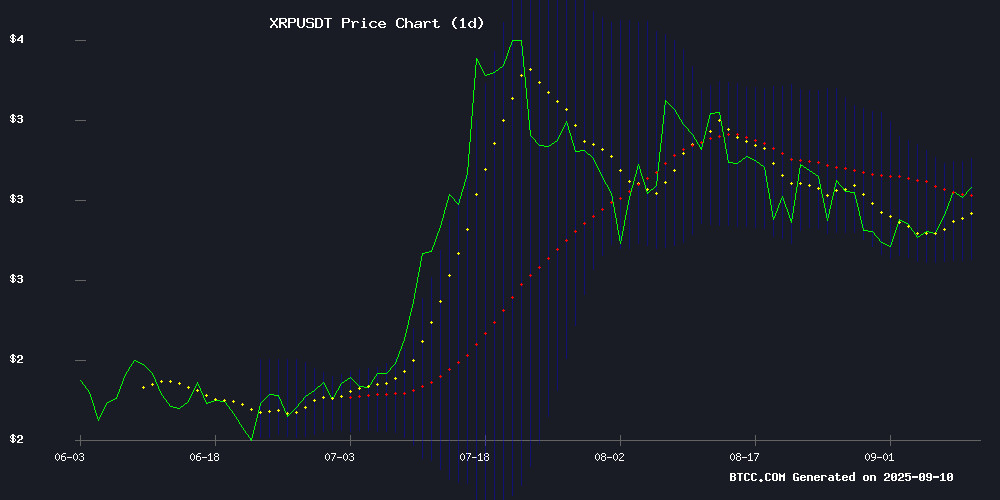

XRP is currently trading at $2.9567, firmly above its 20-day moving average of $2.9002, indicating sustained bullish momentum. The MACD reading of 0.0803 versus 0.1029 shows positive momentum despite the slight negative histogram. According to BTCC financial analyst William, 'The price holding above the middle Bollinger Band at $2.9002 suggests underlying strength. A break above the upper band at $3.0911 could signal further upside potential.'

Market Sentiment: Positive Catalysts Drive XRP Optimism

Recent developments including Ripple's expansion of digital asset custody with BBVA in Spain and the adoption of RLUSD stablecoin for cross-border EV payments are creating positive fundamental momentum. BTCC financial analyst William notes, 'The combination of institutional adoption and strategic token burns provides strong fundamental support. While open interest decline suggests some short-term consolidation, the overall sentiment remains bullish given the ecosystem expansion.'

Factors Influencing XRP's Price

XRP Rebound Signals Growing Momentum for Ripple Investors

Ripple's XRP is gaining traction among investors as its price climbs steadily, outperforming major cryptocurrencies. The token recently rebounded from $2.84, fueling optimism. Technical resilience, upcoming ETF approvals, and compliance upgrades on the XRP Ledger (XRPL) are driving the momentum.

XRP has repeatedly tested the $3 support level, with $2.7 acting as a reliable safety net. The 78.6% Fibonacci retracement level at $2.84 has emerged as a pivotal point, with the next target at $2.96. Traders are eyeing a potential push toward $3.

Anticipation of ETF approvals, with Grayscale, 21Shares, and Bitwise in the pipeline, is fueling the rally. Market participants are closely watching whether XRP can sustain its upward trajectory.

XRP Futures Cool Off as Binance Open Interest Drops 37%

Open interest for XRP futures on Binance has plummeted by 37% since July, signaling a retreat from speculative trading. The metric, which tracks outstanding derivatives contracts, now stands at $1.1 billion—down sharply from its $1.76 billion peak earlier this summer.

This unwind mirrors patterns seen during late 2024's price surge, when leveraged bets flooded the market. The current contraction suggests traders are reducing exposure after XRP's bullish momentum stalled. Such pullbacks often precede periods of price stabilization as excessive speculation evaporates.

VivoPower's Tembo e-LV Adopts Ripple's RLUSD Stablecoin for Cross-Border EV Payments

VivoPower International PLC has expanded its cryptocurrency integration by enabling Ripple's dollar-pegged RLUSD stablecoin for payments within its electric vehicle subsidiary, Tembo e-LV. The solution targets operational inefficiencies in Southeast Asian, African, and Middle Eastern markets where traditional cross-border settlements face prohibitive costs and delays.

The enterprise-grade stablecoin combines 1:1 USD collateralization with institutional compliance frameworks, positioning it as a viable alternative to conventional wire transfers. This development follows VivoPower's earlier commitment to allocate $100 million treasury reserves into XRP, signaling a strategic pivot toward Ripple's payment ecosystem.

Board Chairman Adam Traidman, formerly of SBI Ripple Asia, brings established credibility to the initiative. The adoption creates a tangible use case for blockchain-based settlements in the automotive sector while reinforcing Ripple's growing footprint in emerging markets.

XRP Breaks $3 as Ripple Expands Digital Asset Custody with BBVA in Spain

XRP surged past the $3 resistance level, marking a 5% increase to $3.02 amid rising institutional interest. Analysts now project potential gains in the $8-$10 range as the cryptocurrency breaks out of a multi-month symmetrical triangle pattern.

Ripple's partnership with BBVA to expand digital asset custody services in Spain has bolstered market confidence. Trading volume spiked to $6.78 billion, with XRP's market capitalization approaching $180 billion at press time.

The technical breakout suggests a momentum shift, with crypto analyst JackTheRippler noting the $3 breach opens a path to higher price targets. Institutional adoption through Ripple Custody solutions appears to be driving renewed bullish sentiment.

XRP Price Prediction: How High Could Ripple Price Go if Apple Announces $1.5 Billion XRP Purchase?

Speculation about Apple potentially acquiring $1.5 billion worth of XRP has ignited fervent discussion among crypto traders. The rumor, originating from social media posts, suggests such a move could significantly alter XRP's market trajectory. Immediate market reaction saw XRP breach the $3 resistance level, marking its strongest daily performance in months.

A confirmed purchase by Apple would represent unprecedented corporate adoption of a single cryptocurrency. Analysts highlight the symbolic importance—such an endorsement could accelerate institutional interest in XRP's payment utility. Technical charts indicate potential upside targets at $3.53 and $4.00, with parabolic moves toward $5 possible if liquidity follows institutional participation.

XRP Could Surge to $4-5 on ETF Approval Liquidity Boost, Analysts Say

XRP's recent breach of the $3 psychological barrier signals growing market optimism, fueled by speculation around a potential spot ETF approval. Analysts argue such regulatory endorsement could catapult the token to unprecedented highs, with targets ranging between $4 and $5.

Shawn Young of MEXC highlights a rotational trade into altcoins like XRP, driven by ETF anticipation. "Solana, Dogecoin, and XRP are outperforming a stagnant broader market as ETF speculation triggers disproportionate buying," he notes. The trend reflects a broader pivot from retail-driven volatility to institutional participation.

Lionel Iruk of Nav Markets emphasizes the structural significance of ETF approvals. "An ETF wrapper isn’t just about liquidity—it’s a gateway for traditional investors demanding compliant custody and transparency frameworks," he states. Whale accumulation patterns suggest institutional players are already positioning for this paradigm shift.

Experts Decipher If Ripple’s XRP Lawsuit Saved Crypto World Just in Time

Market analysts are weighing the ripple effects of the U.S. Federal Reserve's anticipated rate cuts on cryptocurrencies, particularly XRP. Weak jobs data has fueled expectations of monetary easing, with gold already hitting a record $3,600 as investors position for policy shifts.

James Rule of the Paul Barron Podcast notes, "Lower rates could funnel fresh capital into alternative assets. We're seeing a surge of first-time crypto entrants—gold, metals, and digital assets are all beneficiaries." XRP's dual appeal as an inflation hedge and cross-border payment solution positions it to capture this inflow.

The asset's legal clarity following Ripple's partial victory against the SEC remains a pivotal factor. The lawsuit's outcome not only bolstered XRP's legitimacy but set precedents affecting the broader crypto regulatory landscape.

Coinbase Exits Top 10 XRP Holders Amid 85% Reserve Drop

Coinbase's XRP reserves have plummeted by 85% in two months, falling from 884 million to just 132 million tokens. The exchange has now dropped out of the top 10 holders, sparking speculation about its commitment to the asset. Bill Morgan, a prominent XRP community figure, quipped about a potential 'delist by holding none' strategy.

Upbit now leads exchange holdings with 5.87 billion XRP, followed by Binance at 2.82 billion and Uphold at 1.74 billion. The dramatic reduction comes amid ongoing regulatory uncertainty surrounding XRP, though Coinbase has not officially commented on the reserve changes.

XRP Price Breaks $3 Following Bullish Inverse Head and Shoulders Pattern

XRP surged past the $3.00 resistance level, marking a 2.34% gain in the last 24 hours. The breakout follows weeks of consolidation between $2.88 and $2.92, with trading volume exceeding $6 billion—a clear signal of renewed market interest.

Technical analysts highlight a confirmed inverse head-and-shoulders pattern, a classic bullish reversal signal. Market watchers now eye the $3.045 resistance level as the next target. "The breakout looks solid," noted one analyst, emphasizing the significance of holding above $2.65 as a critical support zone.

Ripple Conducts Strategic RLUSD Token Burn to Maintain Stability

Ripple has executed its largest RLUSD stablecoin burn in weeks, removing 2.71 million tokens from circulation on September 9. This follows a series of reductions totaling 3 million RLUSD in early September, part of Ripple's supply management protocol to maintain the 1:1 dollar peg.

The stablecoin's trading volume surged 88% to $88.51 million, with market capitalization holding steady at $728 million. RLUSD now ranks among the top 10 stablecoins by market cap as adoption grows, including recent integration by VivoPower for payment solutions.

Ripple (XRP) Breaks $3.00 as Africa Stablecoin Launch Sparks Recovery

XRP surged 2.52% to $3.00 following Ripple's RLUSD stablecoin launch in Africa, with technical indicators showing bullish momentum despite neutral RSI signals. The recovery marks a breakout from last week's consolidation phase, driven by strategic expansion into African markets.

Ripple's introduction of RLUSD across major African exchanges on September 5th has reinvigorated investor confidence in XRP's cross-border payment utility. Large wallet holders accumulated 340 million XRP tokens during the consolidation, signaling institutional positioning for the rally.

Technical analysis reveals a bullish MACD histogram reversal and a breakout from a symmetrical triangle pattern between $2.81 and $2.87. The stablecoin launch addresses real-world demand for efficient remittance solutions in high-growth regions.

XRP Price Predictions: 2025, 2030, 2035, 2040 Forecasts

Based on current technical indicators and fundamental developments, XRP shows strong potential for long-term growth. Here's our projected outlook:

| Year | Conservative Target | Moderate Target | Bullish Target |

|---|---|---|---|

| 2025 | $3.50-$4.00 | $4.50-$5.00 | $5.50-$6.00 |

| 2030 | $8.00-$10.00 | $12.00-$15.00 | $18.00-$20.00 |

| 2035 | $15.00-$20.00 | $25.00-$30.00 | $35.00-$40.00 |

| 2040 | $25.00-$35.00 | $40.00-$50.00 | $60.00-$75.00 |

BTCC financial analyst William emphasizes that 'these projections assume continued adoption in cross-border payments, regulatory clarity, and potential ETF approval which could provide significant liquidity boosts.'